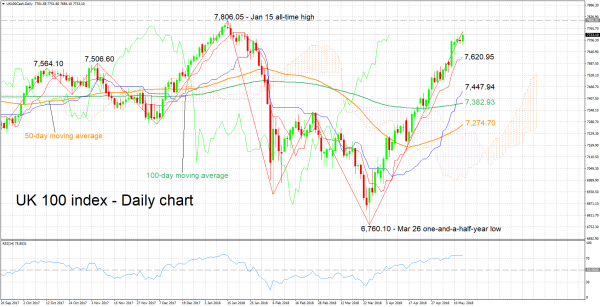

The UK 100 index has posted an impressive rally after hitting a one-and-a-half-year low of 6,760.10 on March 26; in fact the index has advanced in every single week ever since that trough and is currently on track for an eighth straight weekly gain.

The short-term bias is bullish as indicated by the positively aligned Tenkan- and Kijun-sen lines. The rising RSI adds to this view, though notice that the indicator has entered oversold territory above 70; the implication being that a near-term pullback is not to be ruled out.

Resistance to further gains might come around the all-time high of 7,806.05 – including the 7,800 round figure – recorded in mid-January. An upside break might open the way for more bullish movement, increasingly turning the attention to the 8,000 mark.

On the downside, support to declines could come around the current levels of the Tenkan- and Kijun-sen lines at 7,620.95 and 7,447.94 respectively. The area in between the two lines includes a couple of peaks from late 2017, at 7,564.10 and 7,506.60, that might also act as a barrier to losses.

The medium-term picture is looking increasingly bullish, with the index climbing further above the 50- and 100-day moving average lines, as well as above the Ichimoku cloud.

Overall, both the short- and medium-term outlooks are looking bullish at the moment, though there are signs of an overextended market in the near-term.