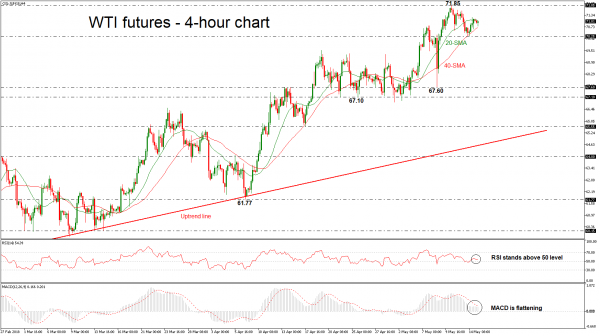

West Texas Intermediate (WTI) crude oil futures have eased after the pullback on the fresh three-and-a-half-year high of 71.85 reached last Thursday. The price is being capped by the 20-simple moving average (SMA) but remains above the 40-SMA in the 4-hour chart. Short-term technical indicators are endorsing the scenario for a potential bearish retracement.

Looking at momentum indicators, the RSI stands slightly above the 50 level with weak momentum, while the MACD oscillator is flattening in the positive territory below its trigger line, suggesting that a negative movement is near.

In the event of a slip below the 40-SMA, this would open the door for the immediate support level of 70.25. A successful close below this level could see a re-test of the previous lows of 67.60, while in case of steeper declines the oil could breach this trough, diving to the 67.10 region.

On the flip side, a move to the upside again could touch the aforementioned three-and-a-half-year high but should the market increase positive momentum above this area, the 73.30 could be the next major focus, taken from the low on November 2014. A strong barrier, though, could be found at the 75.00 handle, identified from the September 2011 low. As a side note, the psychological levels of 71.00, 72.00, 73.00, 74.00 could act as significant obstacles for the bulls as well.

Overall, the crude oil started a bearish correction confirmed by the technical indicators in the near-term, however, the main trend is still bullish in the medium term.