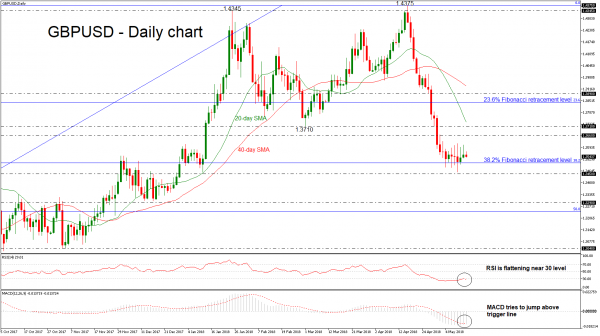

GBPUSD has been underperforming in the past eight days as it has failed to post a significant day of gains or losses. The pair is consolidating slightly above the 38.2% Fibonacci retracement level of 1.3510 of the upleg from March 12 to May 15. Last Thursday, the cable recorded a fresh four-month low of 1.3459, while at the short-term picture the pair lacks a clear trend.

In the daily timeframe, prices are moving sideways and based on technical indicators, momentum is too weak to provide a sustained move higher. The RSI indicator is flattening in the oversold level near the 30 barrier, while the MACD oscillator is trying to jump above its trigger line to create a bullish cross.

If price action remains above the 38.2% Fibonacci mark (immediate support), there is scope to test the 1.3660 resistance level. Clearing this key level would see additional gains towards the next resistance of 1.3710. Rising above it and surpassing the 20-day simple moving average (SMA) near 1.3730 would see prices re-test the 23.6% Fibonacci of 1.3840.

However, if the 1.3510 support fails, then the focus would shift to the downside again towards the 1.3450 support, taken from the low on January 11. If this level is breached, it would increase downside pressure and challenge the 1.3290 hurdle.

To sum up, GBPUSD has been neutral since peaking at 1.3615 and finding support at 1.3450. Near-term weakness is expected to remain as long as price action is taking place near the 38.2% Fibonacci.