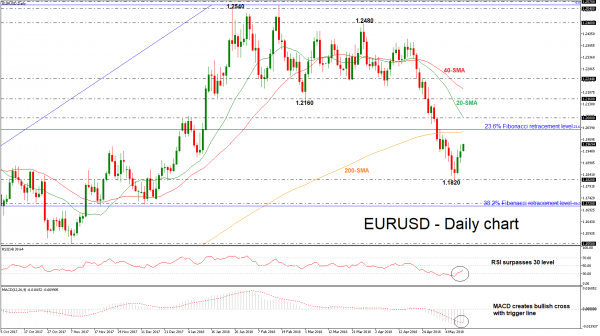

EURUSD has been edging slightly higher since it found a strong support on the 1.1820 barrier last Wednesday, creating two consecutive bullish days and paring some of the previous weeks losses. The 1.1820 key level is a new almost five-month low and the price is still developing below the 23.6% Fibonacci retracement level of 1.2030 of the upleg from January 3 to February 16.

Short-term momentum indicators are also pointing to a continuation of the bullish bias. The RSI indicator holds just above the 30 level and is pointing upwards, while the MACD oscillator is ready for a bullish crossover with its trigger line in the negative territory.

In the event of a continuation of the upside reversal, the 23.6% Fibonacci and the 200-day SMA could act as strong resistance barriers for traders. A penetration of these critical levels would shift the medium-term outlook to a more neutral one as it would take the pair towards the 1.2080 resistance, which overlaps with the 20-day SMA at the time of writing. Further gains would lead the way towards the 1.2160 region, taken from the low on March 1.

On the flip side, further losses should see a re-challenge of the almost five-month low acting as a major support. A slip below this area would reinforce the bearish structure in the daily chart and open the way towards the 1.1720 support, which stands near the 38.2% Fibonacci mark.

To sum up, EURUSD posted four red weekly sessions, however, the last week recorded limited losses, indicating that a bullish correction is possible in the near-term.