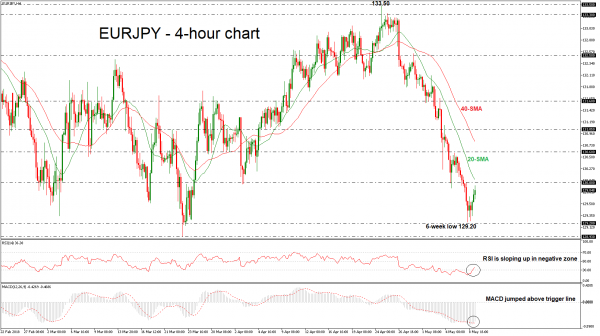

EURJPY is trying to snap the ten consecutive negative daily trading sessions after it created a six-week low near 129.20 on Tuesday. A bullish pullback in the short-term is expected further supported by the technical indicators.

Short-term momentum indicators are also pointing up for a creation of a bullish bias. The RSI indicator is turning positive in the negative zone, while the MACD oscillator recorded a positive cross with the trigger line in the bearish area as well.

The price is ready to touch the 20-simple moving average near 130.00 in the 4-hour chart following the gains over the past few hours. However, a climb above this obstacle could extend gains towards the 130.60 resistance level before re-challenging the 40-SMA of 130.80. A break above these barriers would shift the short-term bearish mode to a more bullish one as it would take the pair towards the 131.05 resistance.

Conversely, a resumption of the bearish correction in the 4-hour chart could drive the price below the 129.20 low until the 128.93 bottom, taken from the bottom on March 23. Further losses should see the August 2018 low of 127.50 come into view.