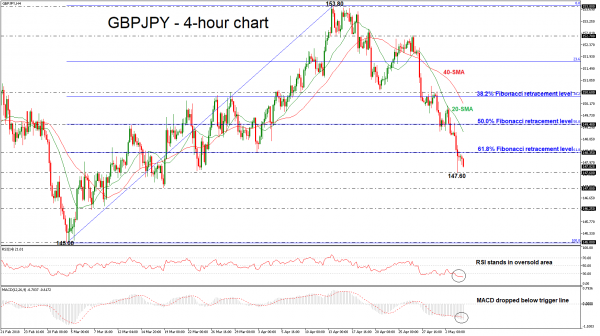

GBPJPY has been underperforming following the bounce off the 153.80 resistance level on April 13 and during Thursday’ssession it reached a new six-week low of 147.58. The aggressive sell-off drove the pair below the 61.8% Fibonacci retracement level of the upleg from 145.00 to 153.80 suggesting a crucial bearish movement.

In the 4-hour chart, the technical indicators dropped to their oversold levels, confirming the negative attitude on price. The RSI indicator slipped below the 30 level and is still sloping down, while the MACD oscillator declined below its trigger line.

In case of further losses below the six-week low (147.58) should see the March 19 trough of 147.00 acting as a major support barrier. A fall below this level would reinforce bearish structure in the medium-term and open the way towards the next key support level of 146.25.

In the event of an upside reversal, the 61.8% Fibonacci mark, which overlaps with the 148.35 barrier could act as a key level before being able to re-challenge the 50.0% Fibonacci of 149.40. Also, above this level, the 38.2% Fibonacci mark of 150.45 would be a significant obstacle for the bulls. Further gains would lead the way towards the 23.6% Fibonacci of 151.75.

Overall, GBPJPY continues the negative pressures and more declines are expected in the near future.