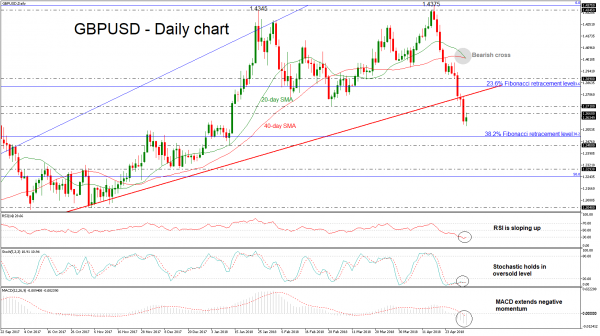

GBPUSD dived over the last two weeks after the bounce off the 1.4375 resistance level, while during yesterday’s daily session the price dropped below the long-term ascending trend line, shifting the bullish outlook to bearish. However, during Wednesday’s session, the pair is paring some losses after reaching an almost 16-month low of 1.3579.

The RSI has fallen into oversold territory but is sloping slightly to the upside. The stochastics are still in oversold levels, with the indicator turning slightly upwards, while the MACD supports a bearish picture since the index continues to increase negative momentum below its red-signal line. Additionally, the 20-day simple moving average is about to post a bearish cross with the 40-day SMA, confirming the recent bearish structure.

Should the market extend losses, support could be met at the 38.2% Fibonacci retracement level of the upleg from 1.2100 to 1.4375 at 1.3508. Steeper decreases could drive the price towards the next immediate support at 1.3450.

Conversely, if the pair bounces up, immediate resistance could be met at 1.3710 taken from the low on March 1. A jump above this obstacle could drive cable north towards the 23.6% Fibonacci mark of 1.3840, signaling a continuation of the upward movement.