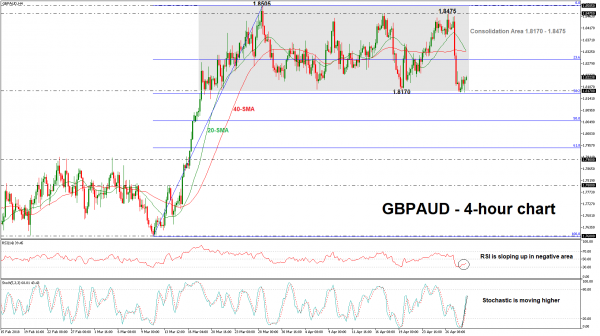

GBPAUD edged sharply lower over yesterday’s trading session and touched the 1.8170 support level. The pair has been holding within a sideways channel since March 19 with upper boundary the 1.8475 resistance level and lower boundary the 1.8170 support, which coincides with the 40-day simple moving average. In the short-term, the technical indicators turned their momentum to positive.

Momentum indicators are pointing up in the short term, although the RSI remains in the negative zone. The stochastic oscillator is moving higher, suggesting an upside reversal is nearing. The 20-SMA is ready for a bearish cross with the 40-SMA, acting as a significant barrier on the upside.

If price action remains above the lower boundary, there is scope to test the 20- and 40-SMAs near 1.8325 in the 4-hour chart. This is considered to be a strong resistance area while clearing this level would see additional gains towards the upper boundary of 1.8475. In case of an upward penetration of the channel, this would open the way towards 1.8505.

On the flip side, a move to the downside and a break of the consolidation area could see the next support of 50.0% Fibonacci retracement level around 1.8050 of the upleg from 1.7600 to 1.8505. A stronger barrier thought, could be found at the 61.8% Fibonacci of 1.7950.