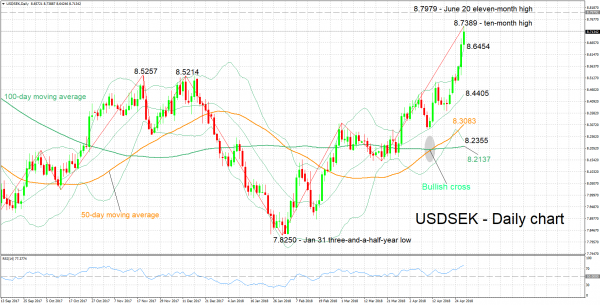

USDSEK hit a fresh 10-month high of 8.7389 earlier on Friday. Indicative of the positive bias in the short-term is the fact that the pair finished higher in all but one of the five previous trading days.

Adding to the conviction for a bullish momentum is the rising RSI. However, the indicator has entered overbought territory above 70, rendering a pullback in the near term possible.

Further gains might meet a barrier around the 11-month high of 8.7979 posted in late June, while an upside break will increasingly start shifting the attention to the 9.00 round figure.

In case of declines, support could come around the upper Bollinger band at 8.6454, with steeper losses potentially meeting support around 8.5257 – this is a previous peak with the range around it encapsulating another top from the recent past at 8.5214.

The medium-term picture is bullish, with trading taking place above the 50- and 100-day moving average lines. Price action also seems to verify the positive signal given by the bullish (golden) cross recorded in mid- to late-April when the 50-day MA moved above the 100-day one. For the record, the pair is trading higher by 6.5% year-to-date.

Overall, both the short- and medium-term outlooks are looking positive, with the overbought RSI cautioning though that some selling in USDSEK might take place in the near term.