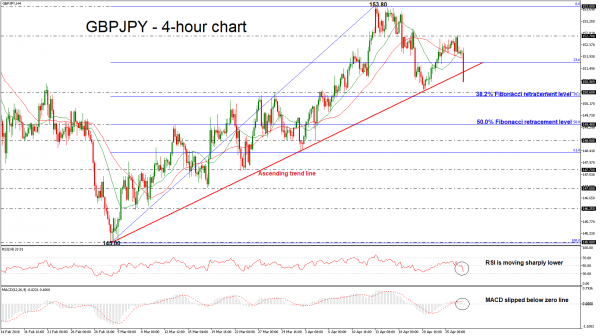

GBPJPY has been underperforming since Thursday’s trading session after it found a resistance obstacle at the 152.70 barrier. When looking at the bigger picture, the price had been developing within an ascending movement since March 2after the pullback on the 145.00 significant psychological level, however, currently, the price has fallen sharply below this line. The short-term technical indicators are bearish and point to more weakness in the market.

In the 4-hour chart, prices are trading well below the 20- and 40-simple moving averages over the last few sessions signaling a continuation of the decline. The RSI indicator is moving sharply lower, approaching the negative threshold of 30, while the MACD oscillator is dropping below the trigger line, falling in the negative territory.

Should prices continue the bearish correction, the next significant area to have in mind is the rising trend line around the 151.50 price level. The pair has just breached this trend line but in case of a session close below it , this would increase bearish pressures and the positive medium-term outlook could shift to negative until the 150.60 support. Further losses could push GBPJPY towards the 50.0% Fibonacci retracement level of 149.40 of the upleg from 145.00 to 153.80.

On the flip side, a possible scenario is a rebound on the rising trend line and the resumption of an upward movement once again. A strong resistance level to watch is the 152.70 region, while above that, the next major resistance is the two-month high of 153.80.