The USDCAD pair has returned to the previously broken red trend line and is consolidating in the area around 1.28363. A break higher targets today’s high at 1.28641, followed by 1.28940 and the area of resistance containing the recent highs, starting at 1.29200 up to 1.29300. A move that is sustained over this zone could push prices to test 1.30000. The March high is at 1.31241, but 1.30704 needs to be overcome on the next leg higher.

Support is found at 1.27773, with a stronger area at 1.27243 that is supported by the 100 and 50-period moving averages. The 200-period MA is above this area at 1.27472 and it may bar the way lower. The ultimate support comes from the top of the recent descending channel that the price broke higher from on Friday, at 1.27092. This trend line is now at 1.26620. A loss of this line would lead to a false breakout and a lower reaction in price targeting the recent low of 1.25230.

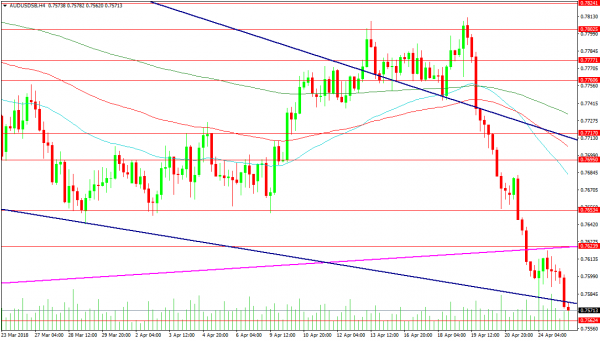

AUDUSD

This pair has taken a leg lower, creating a false breakout last week, which collapsed on Thursday. The major support at 0.76534 was taken out on Monday, dragging price down to the current level around 0.75700. The low created here is 0.75624, with a loss of this level targeting 0.75000. Should price push further down, 0.74990 is the low from December, with 0.74200 below, followed by 0.73700. Traders will be eying the 0.68264 level as the low from 2016 and citing the break below the magenta trend line as a bear flag trigger.

A break above 0.76240 gives long positions some hope, but the black trend line was retested as resistance today at 0.75750 and it held. As mentioned, the 0.76534 level is now resistance, with 0.76950 above and 0.77170 a key area. The 0.77600 level was where selling accelerated from the double top level of 0.78100.