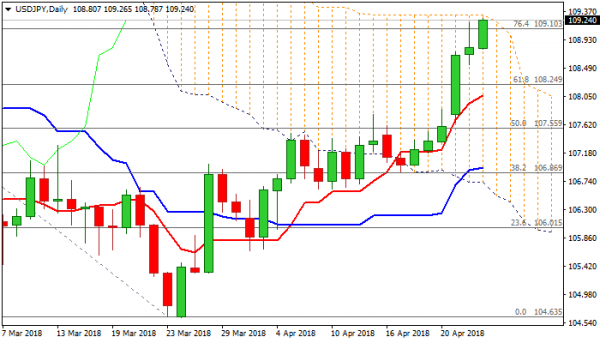

The pair probes again above 100SMA (108.95) in early Wednesday’s trading after previous day’s attempts through 109 handle stalled at 109.20 and session closed below 100SMA pivot. The dollar remains well supported as US bond yields continue to rise and hit four-year high above 3%, despite many market observers expectations that the rally would be capped here. Fresh rally neutralizes initial signs of stall on Wednesday’s failure at 100SMA which left daily candle with long upper wick. Bullish daily techs boost positive sentiment for eventual break through daily cloud top (109.21) and fresh acceleration on triggering stops parked above daily cloud, for extension towards next targets at 110.00/26 (psychological barrier/200SMA). Daily close above cloud is needed to generate fresh bullish signal and confirm scenario. Slow stochastic is overbought on daily chart but continues to point higher, while daily RSI is at the border of overbought territory and 14-d momentum turning lower, suggesting consolidative/corrective action in the near-term. Broken Fibo barrier at 108.25 and rising daily Tenkan-sen, mark solid supports where extended dips should find ground.

Res: 109.30, 109.78, 110.00, 110.26

Sup: 108.95, 108.78, 108.54, 108.25