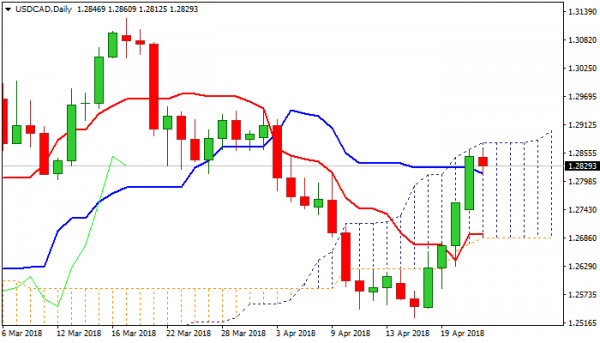

The pair holds within 50-pips consolidation on Tuesday after strong four-day rally was capped by daily cloud top (1.2862) on Monday and today’s action failed to extend further as cloud is widening and top lies at 1.2875.

Recovery rally retraced over 50% of 1.3124/1.2527 descend but shows initial signs of stall under key barrier, as strongly overbought slow stochastic is reversing and daily RSI turning south. Also, profit-taking action after 2.5% advance in four days, could accelerate pullback which was so far held by daily Kijun-Sen (1.2815).

Close below the latter would signal deeper correction of 1.2527/1.2860 rally and expose initial supports at 1.2782/68 (Fibo 23.6%/55SMA), while further easing would open way towards pivotal supports at 1.2733/30 (Fibo 38.2%/20SMA).

Meanwhile, extended consolidation could be expected while daily Kijun-sen holds, as US dollar remains supported in the near-term and today’s upbeat US Consumer confidence and New home sales data could further boost dollar’s bulls.

Bullish scenario requires firm break through cloud top (1.2875) and Fibo 61.8% of 1.3124/1.2527 descend, to open way towards psychological 1.30 barrier

Res: 1.2875; 1.2943; 1.3000; 1.3076

Sup: 1.2815; 1.2782; 1.2768; 1.2730