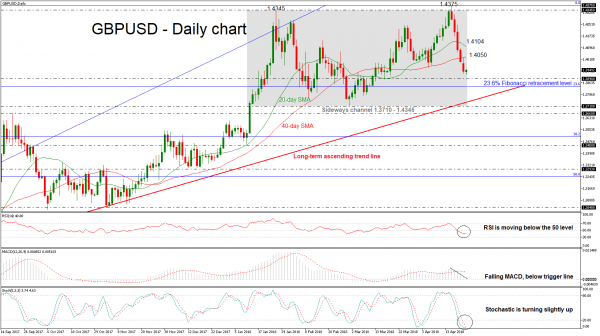

GBPUSD sank aggressively over the last five trading days following the bounce off the 22-month high of 1.4375, which it hit last week. The pair recorded a new five-week low during today’s Asian session of 1.3917. Price action is at the moment taking place not far above this bottom.

The RSI has fallen into negative territory but is sloping slightly to the upside, indicating that the market could weaken a little bit in the short-term to provide further losses. Stochastics are still in oversold levels, with the indicators turning slightly upwards, while the MACD supports a bearish picture since the index continues to increase negative momentum below its red-signal line.

Should the market extend losses, support could be met between the 1.3890 level and the 23.6% Fibonacci retracement level of 1.3840 of the upleg from 1.2100 to 1.4345, which holds near the long-term ascending trend line. Steeper decreases though could drive the price below the significant diagonal line, shifting the bias to bearish. Then, the market could challenge the 1.3660 – 1.3710 support zone.

Conversely, if the pair bounces up, immediate resistance could be met at the 40-day simple moving average near 1.4050 and then it could touch the 20-day SMA around 1.4104. A jump above these obstacles could drive the price north towards the 1.4345 resistance level

Looking at the medium-term, the price has been trading within a sideways channel since mid-January with upper boundary the 1.4345 resistance level and lower boundary the 1.3710 support. Turning to longer-timeframe, the cable is still endorsing a bullish scenario as it has been holding in an ascending move since March 2017.