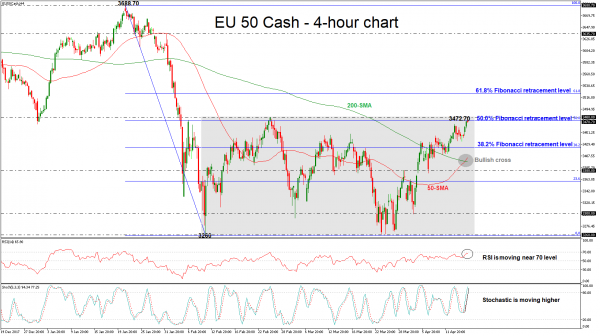

EU 50 stock index has advanced considerably since roughly the end of March, hitting a seven-week high during Tuesday’s session. Price action is at the moment taking place not far below this peak. The index is developing within a trading range the last couple of months with upper boundary the 3472.70 resistance and lower boundary the 3260 support. The technical picture supports that the bullish run remains in the near-term as both are holding in the positive zone.

Looking at momentum indicators, the RSI indicator is moving near the overbought level, while it is flattening. Also, the stochastic oscillator is heading higher and the %K line is moving well above its %D line, signaling further gains in the 4-hour chart. It is worth mentioning that in the medium-term, the 50-simple moving average (SMA) posted a bullish cross with the 200-SMA, indicating strong buying interest.

Currently, the price is touching the 50.0% Fibonacci retracement level of 3472.70 of the downleg from 3688.70 to 3260. In the wake of positive pressures, the market could hit the next immediate resistance of 3480. A successful jump above the aforementioned zone could open the door towards the 61.8% Fibonacci near 3524.

On the flip side, a move to the downside could see support at the 38.2% Fibonacci mark of 3423. A stronger barrier, though, could be found at the bullish cross of the 50- and 200-day moving averages around 3397 at the time of writing. In case of more declines, 3380 is acting as a major support level.