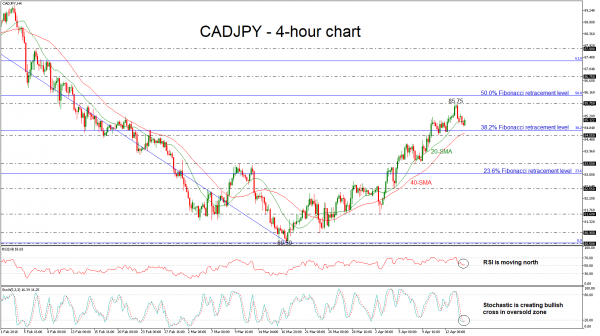

CADJPY has been making higher lows and higher highs since the middle of March when it touched a nine-month low of 80.50, pausing the downtrend and creating a bullish tendency. The technical indicators continue to send bullish signals, suggesting that the strong upward movement in the market is not over yet.

In the 4-hour chart, the Relative Strength Index (RSI) is sloping to the upside, while the %K line of the stochastic oscillator is creating a bullish cross with the %D line in the oversold zone, signaling further strong gains in price action. Over the last few hours, the pair headed above the 20-simple moving average (SMA) and is holding well above the 40-SMA.

If the market manages to pick up speed, the price could touch the two-month nearby resistance of 85.75. A jump above this level could open the way towards the 50.0% Fibonacci retracement level of 86.00 of the downleg from 91.56 to 80.50. Moreover, in case of further upside movement, it would raise the chances for a challenge of the 86.75 barrier.

Should prices decline, immediate support could be found around the 38.2% Fibonacci level of 84.74, an area which is near the 84.55 support. Then a leg below that level, the pair could meet the 83.50 barrier before the focus shifts to the 23.6% Fibonacci near 83.12.