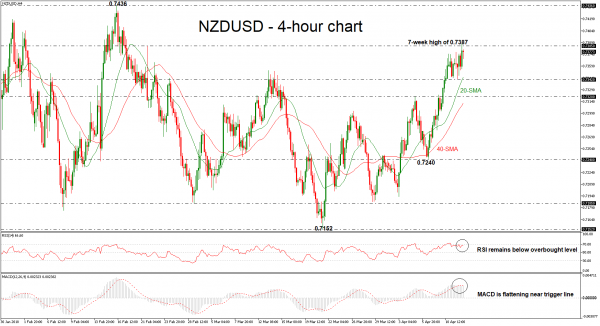

NZDUSD surged to a 7-week high of 0.7387 during today’s European session following the aggressive buying interest that started after the rebound on the 40-day simple moving average of 0.7240 last Friday. The technical indicators, though, are sending neutral to bearish signals, suggesting that the strengthening of the market is weakening.

In the 4-hour chart, the Relative Strength Index (RSI) has flattened near overbought levels, indicating that the market could weaken a little bit in the short-term until the index jumps above that threshold. The MACD oscillator supports a neutral picture, as well, as the index,continues to flatten near its red-trigger line.

If the market manages to pick up speed and jumps above the 0.7385 resistance level, it could open the door towards the 0.7436 strong barrier. A significant run above the aforementioned obstacle could extend gains until the 0.7560 peak, taken from the high of July 2017.

Should prices decline, immediate support could be found around 0.7342 support, which holds near the 20-day simple moving average (SMA). A close below this level could slip the pair until the next support at 0.7320, raising chances for further losses. In case of further downside pressure, prices could slip towards the 0.7240 support.