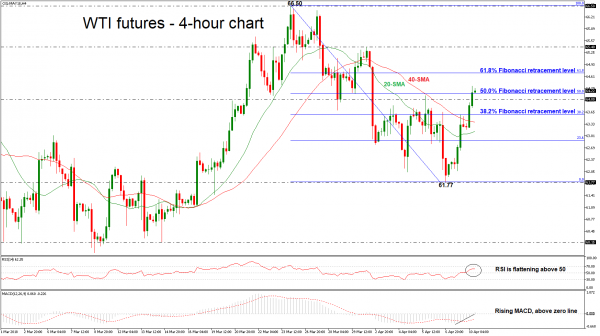

WTI crude oil futures have come under renewed buying interest, rising back above the 64.00 strong psychological level. After the significant rebound on the 61.77 support, the price reversed and is trying to pare some of the previous week’s losses. Oil prices jumped to a new one-week high and challenged the 64.35 price level during today’s European session.

Looking at momentum oscillators in the 4-hour chart, they suggest further bullish movements may be on the cards in the short-term. The Relative Strength Index (RSI) is above its neutral 50 line, detecting positive momentum, but is flattening. The MACD oscillator has just entered positive ground as it was rising from the bearish territory.

In case of further upside pressure, immediate resistance may be found near the 61.8% Fibonacci retracement level around 64.70 of the downleg from 66.50 to 61.77. If buyers manage to push the price above that hurdle, that would mark a higher intraday high in the 4-hour chart, increasing the probability for further bullish extensions. Resistance may be found initially at 65.40, identified by the April 2 top.

Conversely, if the bears retake control, prices advances may stall and slip below the 64.00 handle. The next support level to have in mind is the 38.2% Fibonacci mark near 63.58. A drop below the aforementioned obstacle could open the way towards the 40 and 20 simple moving averages at 63.37 and 63.14 respectively.