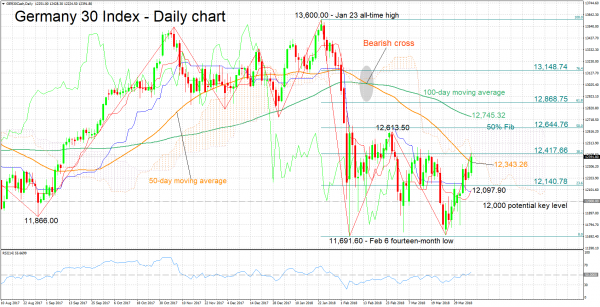

The Germany 30 index has advanced considerably after hitting a two-month low of 11,703.80 on March 26 and coming close to the more than one-year trough of 11,691.60 recorded in early February. Earlier on Tuesday, the index posted a near four-week high of 12,428.30.

In terms of the short-term picture, the Tenkan-sen line has just crossed above the Kijun-sen, this being a positive alignment that supports a bullish bias. The RSI lends credence to this view: the indicator continues to rise, having moved above the 50 neutral-perceived level.

Resistance might be taking place at the moment around the 38.2% Fibonacci retracement level of the January 23 to February 6 downleg at 12,417.66. The area around this level encapsulates the Ichimoku cloud bottom (12,440.48), while it was somewhat congested in recent months. An upside break from this area would shift the attention to the range around the 50% Fibonacci mark at 12,644.76.

On the downside, support could come around the current level of the 50-day moving average at 12,343.26 which failed to act as resistance earlier in the day and might instead provide support. In case of steeper declines, the focus would start to turn increasingly to the 23.6% Fibonacci level at 12,140.78.

The medium-term picture is looking mostly bearish, with trading taking place below the Ichimoku cloud and the 50- and 100-day MA lines maintaining a negative slope – a bearish cross has been in place since mid-February when the 50-day MA moved below the 100-day one as well. However, a more decisive break above the 50-day MA, one that sends price action inside the Ichimoku cloud, would be indicative of a neutral outlook for the index.

Overall, the short-term picture is positive, with the medium-term being negative for the most part though with a neutral tilt as well.