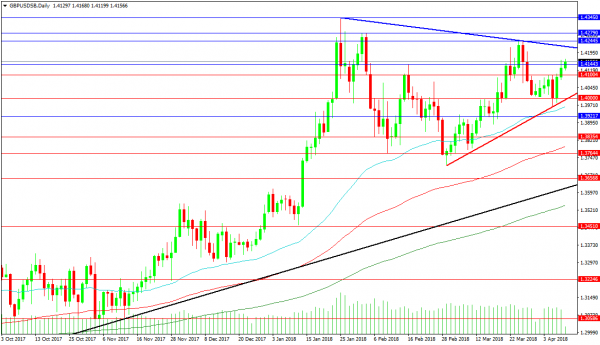

The GBPUSD pair is breaking higher today, after managing to close above the 1.41000 level yesterday. This move gives long positions a bit of confidence, with the falling blue trend line at 1.42162 the main obstacle on the way to the high of 1.43450. There is also a band of resistance between the 1.42445 and 1.42790 levels but a solid break of the trend line could be enough to carry the price higher regardless.

Support comes at the previously mentioned 1.41000 level, which is acting as a point of control. Should price fall below this level, the rising trend line at 1.40000 comes into focus. The 50 DMA is positioned to provide support at 1.39640, with the 1.39217 level below that. The 100 DMA is at 1.37940 with support at 1.38354. A strong level of support is found at 1.37644 and, should this be broken, a retest of the rising black trend line support at 1.36140 may occur.

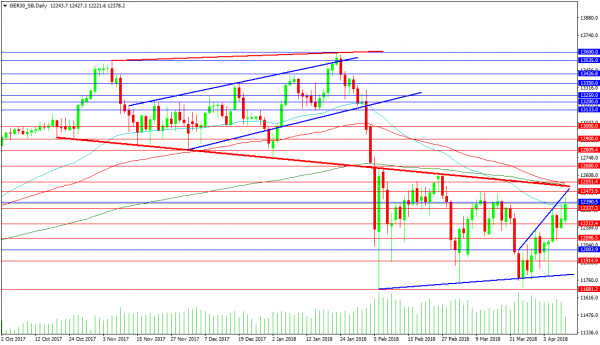

GER30 Index

Price remains below the descending red trend line that has dominated the chart for the last few months. This trend line is supported by the 100 and 200 DMAs and the 12550.00 level. A move back above this area, in conjunction with the risk-on sentiment in the broader market, would be a bullish development for this index. In the meantime, the 12390.00 level is acting as resistance, with price testing the area this morning on a strong rebound after yesterday’s late selloff in the US session. The 12473.9 level is providing short-term resistance as the high from early March.

Support comes from the 50 DMA at 12357.80, with the 12337.30 level close by. This is followed by 12212.40 and the 12100.00 area, with further support at 12000.00 and 11915.00. The supporting blue trend line is located at 11800.00 with the 11681.20 level holding the way to 11500.00.