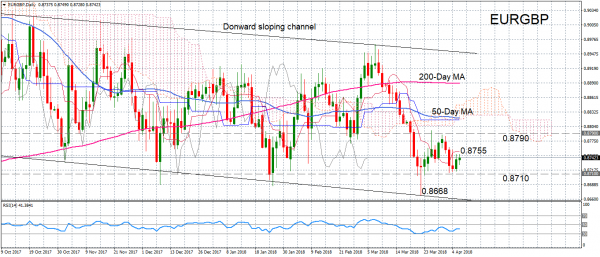

EURGBP remains in a slightly downward tilting channel, which has been in place since September 2017. The longer-term neutral to bearish outlook was recently confirmed again when the pair touched a 9-month low of 0.8668 on March 22. It has since recovered from that low but the rebound was halted after finding resistance around 0.8790.

In the near term, a fresh upside push is possible with prices looking to post a second straight session of gains today. However, the RSI appears to be flatlining before it’s managed to cross into positive territory above 50, suggesting sideways trading is more likely in the short term.

Should the positive momentum gain further traction though, fresh resistance could come at the tenkan-sen line around 0.8755. A break above this level could lead prices towards the 0.8790-0.8800 resistance region. Further gains would bring the 50-day moving average (currently around 0.8820) into view. A successful challenge of the 50-day moving average would shift the near-term bias to bullish as well as take price action above the Ichimoku cloud and into the upper half of the channel.

To the downside, immediate support is likely to come from the 0.8710 mark, which has proved a strong support area in the past. Below that, the March low of 0.8668 is the next support to watch. A breach of this level could lead prices below the lower channel line and deepen the bearish outlook in the medium term.