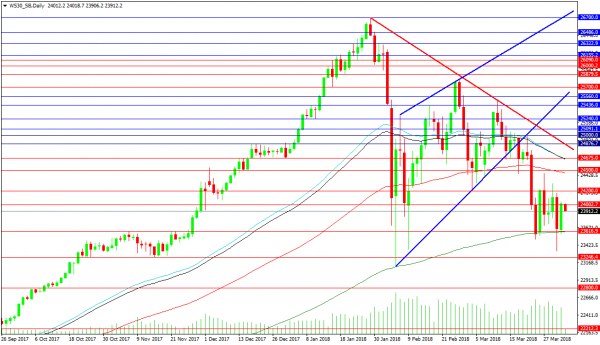

The US30 Index has retested its 200 DMA once again, after breaking down from its bearish rising wedge. It has moved back up to resistance at 24000.00 and remains in this vicinity. Traders are eying the chart for a potential break out, citing 24200.00 as a resistance level to overcome, and a break above 24500.00 and the 100 DMA as confirming the move. The 50 DMA is at 24675.00, with the descending trend line resistance at 24876.00 and a target of 25560.00, followed by the old high at 26700.00.

Support at the 200 DMA at 23617.00 would need to be taken out to target the lows at 23333.50 and 23108.90. Intermediate support is found at 23246.40, with 22800.00 below, and 22212.30 as important support and resistance from September.

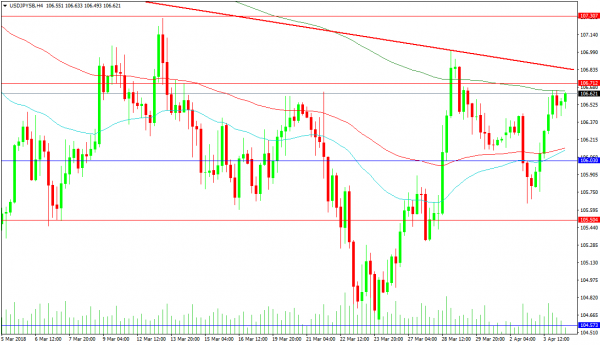

The USDJPY pair has rebounded from support at 104.573 and moved back above 106.000. There are strong signs that a bottom is being formed here. This would be confirmed with a strong break above the red trend line at 106.850. On a break of this level, short positions could become squeezed, with resistance at 107.307 and 107.917 coming into play. Above 108.000 there is strong resistance around 108.750. For now, the 200-period MA is acting as resistance at 106.648 and this can become supportive if breached.

Support at the combined 50 and 100-period MAs is located at 106.140. This is above support at 106.030. The low of 106.654 remains supportive, with 105.504 below. The 105.000 level is important psychologically, with the low from the 23rd of March creating a base. A drop below this level could be a precursor for a test of 100.000, as the price is currently building energy for a move in some direction.