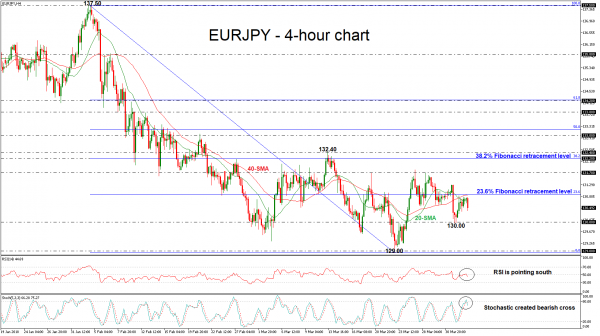

EURJPY remains under pressure in the medium-term and risk is still to the downside as prices continue to drift lower from the 137.50 strong resistance level. Over the last two months, the price has no clear tendency as it is trading within a range, bound by the 129.00 and 132.40 levels. The short-term technical indicators are bearish and point to more weakness in the market.

Looking at the 4-hour chart, the pair is looking capped by the 20- and 40-simple moving averages (SMAs) which are negatively aligned. The RSI indicator is pointing south and slipped below the threshold of 50, while the %K line of the stochastic oscillator created a bearish cross with the %D line near the overbought zone, suggesting further losses.

If prices remain below the two SMAs, there is scope to test the 130.00 key psychological level. Clearing this barrier would see additional declines towards the 129.00 handle. This is considered to be a strong obstacle which has been rejected a few times in the past.

An alternative scenario is a climb above the 23.6% Fibonacci retracement level near 131.00 of the downleg from 137.50 to 129.00. Then the focus would shift to the upside towards the 131.70 resistance level. If this level breached, the next barrier to watch is the 38.2% Fibonacci of 132.20.