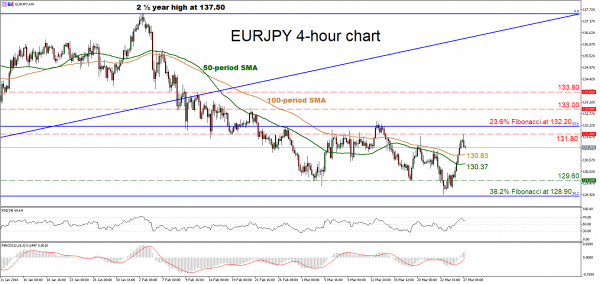

EURJPY rebounded on Friday, after touching a 7-month low of 128.90. The pair surged to encounter resistance at the 131.80 barrier earlier today and has since pulled back somewhat, currently trading near 131.20. Despite the latest bounce though, EURJPY is still 4.5% lower from its 2 ½ – year high of 137.50 reached in early February.

Looking at momentum oscillators, in the 4-hour chart, the Relative Strength Index (RSI) is above its neutral-perceived 50 level detecting positive momentum, though it met resistance near its 70 line and has turned down somewhat. Meanwhile, the MACD lies in positive territory and is also above its trigger line. Combined, these paint a cautiously positive picture for the pair in the near-term, something supported by the price action being above both the 50 and the 100-period moving averages.

In case of further advances in the pair, immediate resistance may be found near the latest top, at 131.80. Further bullish extensions could stall near the 132.20 area, which is the 23.6% Fibonacci retracement of the April 2017 – February 2018 upleg, from 114.80 to 137.50. A decisive break above that zone would mark a higher high on the 4-hour chart, which could set the stage for further gains, initially towards the 133.00 barrier, marked by the highs of February 21.

On the flip side, if the bears retake control, support can come near the 50 and 100 period moving averages, at 130.83 and 130.37 respectively. More declines would open the way for the 129.60 hurdle, identified by the lows of March 19, and subsequently for the pair’s recent bottom at 128.90, which is also the 38.2% of the aforementioned Fibonacci retracement. A downside violation of 128.90 would mark a fresh lower low, increasing the likelihood for more bearish extensions. In such case, buy orders may be found near 127.55, the August 2017 low.