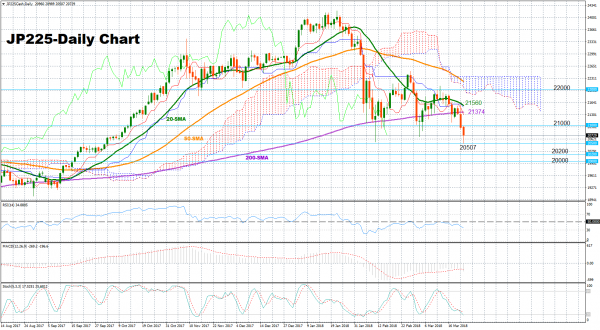

The Japan 225 stock index had a rough ride in recent days, extending negative momentum towards a five-month low of 20,507 during today’s Asian session. While the index’s range-bound trading started in early February remains very much in place, technical indicators point to further downside movements in the short-term, but such moves may soon lose steam given that the indicators are not far away from oversold levels.

The RSI continues to fluctuate in bearish territory below 50 and is currently moving downwards towards oversold levels, meaning that the risk is tilted to the downside in the short-term, though, a trend reversal could occur if the indicator falls below 30. The fast stochastics are also negatively sloped and around their oversold zone. MACD adds to the bearish picture as well, with the indicator gaining pace on the downside.

Should the market stretch lower, support could come first at around 20,500 before the focus shifts to 20,200, a frequently congested area during May-August. A drop under the 20,200 area, could raise bearish sentiment and drive the index further down to the 20,000 psychological level.

On the other hand, if the market rebounds, resistance could be found around the 21,000 handle, with a close above the area between 21374-21560, where the 200-day and the 20-day simple moving average lines are currently located, could decisively fuel bullish sentiment. In this case, the door could open to the 22,000 key-mark.

Turning to the medium-term picture, the structure is bearish given that price actions are currently taking place below the Ichimoku cloud and all the moving average lines displayed.