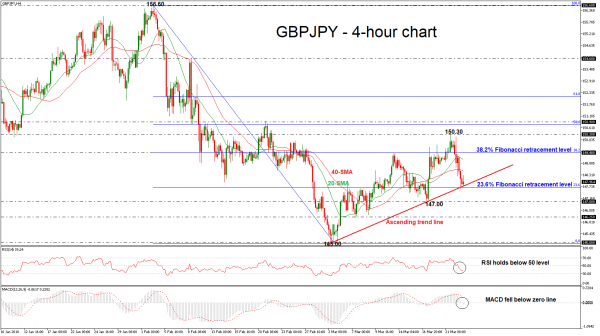

GBPJPY has reversed back down again after finding resistance at the one-month high of 150.30 achieved this week. The price plunged below the 38.2% Fibonacci retracement level of the downleg from the February 2 high of 156.60 to the March 2 low of 145.00.

Meanwhile, the price is re-challenging the 23.6% Fibonacci mark around 147.70, which holds near the short-term ascending trend line. The diagonal line has been standing since February.

Momentum indicators are pointing to a neutral to negative bias in the short-term with the RSI indicator bottoming out within the 30 and 50 level and the MACD oscillator turning negative below the trigger line, suggesting that a bearish movement is nearing again.

In the wake of negative pressures, the market could meet support near the 147.00 handle. A successful close below this level could see a retest of the previous low of 146.25, while in case of steeper declines, the pair could breach this barrier, diving towards the 145.00 psychological obstacle.

On the flip side, a move on the upside could see immediate resistance at the 40 and 20 simple moving averages in the 4-hour chart near 148.50 and 149.00 respectively. A stronger barrier could be found at the 38.2% Fibonacci mark of 149.40 since any strong violation of this price level could increase chances for further gains probably towards the 150.30 resistance.