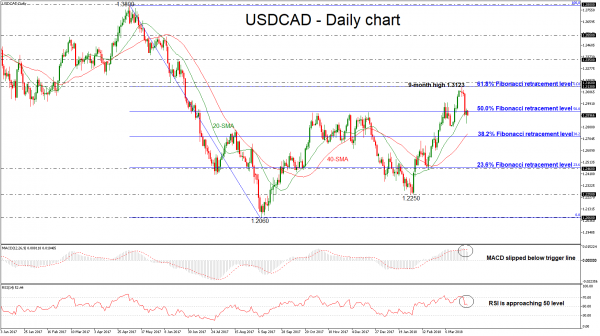

USDCAD plummeted aggressively on Wednesday after the pullback to the 61.8% Fibonacci retracement level near 1.3130 of the downleg from 1.3800 to 1.2060. The price came under heavy selling pressure after hitting a 9-month high. However, during yesterday’s trading session it pared some losses and posted a green day.

Currently, the price is developing slightly below the 50.0% Fibonacci level of 1.2930, while holding below the 20-day simple moving average (SMA).

Short-term technical indicators are pointing to a continuation of the bearish bias. The MACD oscillator dropped below the trigger line and is retreating while remaining in the positive zone. Also, the Relative Strength Index (RSI) slipped from the overbought area and is heading south towards the threshold of 50.

Further losses should see the 38.2% Fibonacci mark of 1.2720 come into view, which is standing near the 40-day SMA. A drop below this level would reinforce the bearish structure in the short-term and open the way towards the next key support level of 1.2460, which is near the 23.6% Fibonacci.

An alternative scenario is the event of an upside reversal. A bullish run above the 1.2930 resistance level (50.0% Fibonacci) could move the price until the 1.3130 – 1.3160 zone which is acting as a strong obstacle. Further gains would lead the way towards the 1.3350 resistance barrier