Key Highlights

- The British Pound made a nice upside move and traded above 149.00 against the Japanese Yen.

- There is a major ascending channel forming with support at 148.20 on the 4-hours chart of GBP/JPY.

- The UK Claimant Count Change came in at 9.2K in Feb 2018, compared with the forecast of -5.0K.

- Today, the BOE interest rate decision is scheduled and the market is looking for no change in rates from 0.50%.

GBPJPY Technical Analysis

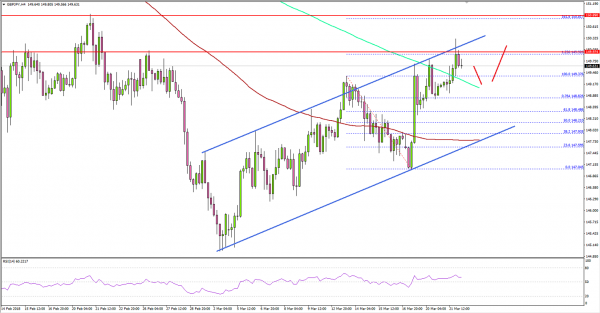

The British Pound started a decent uptrend from the 147.04 low against the Japanese Yen. The GBP/JPY pair climbed above 148.50 and it seems like the pair may continue to move higher.

Looking at the 4-hours chart of GBP/JPY, the pair is trading well above the 149.00 pivot level and the 100 simple moving average (red, 4-hours). It broke the last swing high of 149.37 and it tested the 1.236 Fib extension of the last drop from the 149.37 high to 147.04 low.

On the positive side, there is a major ascending channel forming with support at 148.20 on the 4-hours chart of GBP/JPY. If the pair succeeds in moving above the 150.00 barrier, there may perhaps be a test of the 150.80 resistance.

The mentioned 150.80 resistance also represents the 1.618 Fib extension of the last drop from the 149.37 high to 147.04 low. On the flip side, if there is a downward correction, the pair is likely to find support near 148.50 and then around the channel support.

Recently in the UK, the Claimant Count Change report for Feb 2018 was released by the Office for National Statistics. The market was looking for a change of -5.0K compared with the previous -7.2K.

The real outcome was disappointing since there was no decline in the count, but instead there was a rise of 9.2K. Moreover, the last reading was revised to -1.6K. On the positive note, the ILO Unemployment Rate dropped from 4.4% to 4.3%.

The report added that:

The unemployment rate (the proportion of those in work plus those unemployed, that were unemployed) was 4.3%, down from 4.7% for a year earlier and the joint lowest since 1975.

The market sentiment broadly favored the British Pound. However, today’s BOE interest rate decision and retail sales report in the UK could impact both GBP/USD and GBP/JPY in the near term.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for March 2018 (Preliminary) – Forecast 59.8, versus 60.6 previous.

- Germany’s Services PMI for March 2018 (Preliminary) – Forecast 55.0, versus 55.3 previous.

- Euro Zone Manufacturing PMI March 2018 (Preliminary) – Forecast 55.5, versus 55.5 previous.

- Euro Zone Services PMI for March 2018 (Preliminary) – Forecast 55.0, versus 55.3 previous.

- US Manufacturing PMI for March 2018 (Preliminary) – Forecast 58.1, versus 58.6 previous.

- US Services PMI for March 2018 (Preliminary) – Forecast 55.8, versus 55.9 previous.

- US Manufacturing PMI for March 2018 (Preliminary) – Forecast 55.5, versus 55.3 previous.

- UK Retail Sales for Feb 2018 (YoY) – Forecast +1.3%, versus +1.6% previous.

- UK Retail Sales for Feb 2018 (MoM) – Forecast +0.4%, versus +0.1% previous.

- BoE Interest Rate Decision – Forecast 0.50%, versus 0.50% previous.