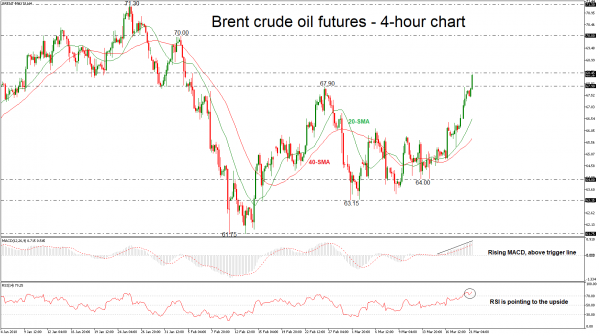

Brent crude oil futures reached a fresh six-week high of 68.28 during today’s European session and extended oil’s bullish run, which started from the 64.00 handle. Prices broke above the 67.90 key level and are trading well above their moving averages. The bullish picture in the short-term is further supported by the technical indicators.

In the 4-hour chart, the indicators are pointing to a continuation of the bullish bias. The MACD oscillator is moving sharply higher above its trigger and zero lines, while the RSI indicator is holding in the overbought zone with strong momentum.

The next immediate resistance level to have in mind is the 68.45 barrier. A successful jump above the aforementioned level could open the door for the important psychological level of 70.00.

In the event of a downside reversal, the 20-day simple moving average (SMA) near 66.55 at the time of writing could act as a major support point. Further losses could push the price towards the 64.00 support barrier and shift the short-term bullish bias to bearish.