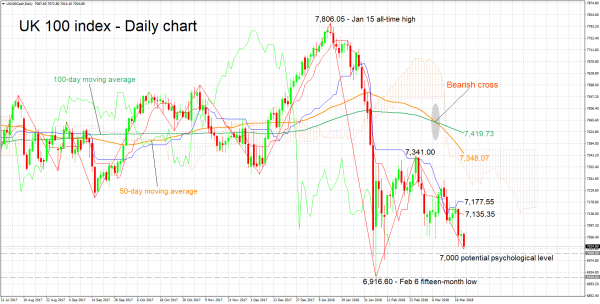

The UK 100 index has fallen by 4.3% after recording a one-and-a-half-month high of 7,341.00 on February 26; if the all-time high of 7,806.05 is used as a reference point, then the loss amounts to a whopping 10.0%. Earlier on Wednesday, the index hit a six-week low of 7014.10, while it is currently trading not far above this trough.

The short-term bias is looking bearish as indicated by the negatively aligned Tenkan- and Kijun-sen lines.

Support for the index could be currently taking place around the 7,000 handle that may be of psychological significance. A violation of the area around this level would turn the attention to the 15-month low of 6,916.60 from February 6 for additional support.

On the upside, resistance to advances might come around the current levels of the Tenkan- and Kijun-sen lines at 7,135.35 and 7,177.55 respectively.

In terms of the medium-term picture, it is looking negative at the moment. Price action is taking place below the Ichimoku cloud, as well as below the 50- and 100-day moving average lines which maintain a negative slope. In addition, a bearish cross was recorded in early March when the 50-day MA moved below the 100-day one.

Overall, both the short- and medium-term outlooks are currently looking bearish.