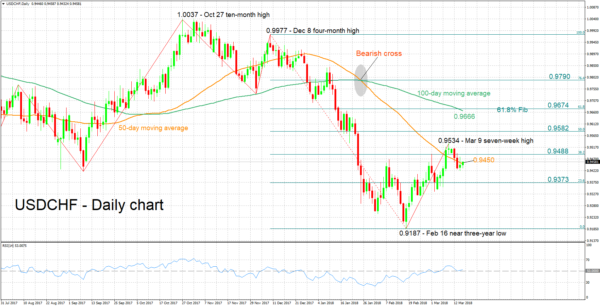

USDCHF has advanced is recent weeks, distancing itself from the near three-year low of 0.9187 hit on February 16. Last Friday, the pair posted a seven-week high of 0.9534.

The short-term bias is looking cautiously positive, with the RSI continuing to rise.

The pair has managed to marginally exceed the 50-day moving average line at 0.9450, with immediate resistance potentially coming around the 38.2% Fibonacci retracement level of the December 8 to February 16 downleg, at 0.9488. Not far above and in case of stronger bullish movement, last week’s multi-week high of 0.9534 could act as a barrier to the upside as well.

On the downside, support might come around the 23.6% Fibonacci mark at 0.9373; the area around this point was congested recently. Further below, the near three-year low of 0.9187 that was recorded around mid-February would increasingly come into view, with some round levels – for example, the 0.93 handle – having the capacity to provide support before that.

The medium-term picture is looking mostly bearish, with the pair trading lower by 2.9% year-to-date. In addition, both the 50- and 100-day MA lines are currently maintaining a negative slope, while a bearish cross was recorded in late January when the 50-day MA moved below the 100-day one. Should the pair move further above the 50-day MA though, this would increasingly shift the outlook towards a more neutral one.

Overall, the short-term outlook is looking predominantly bullish and the medium-term appears bearish for the most part.