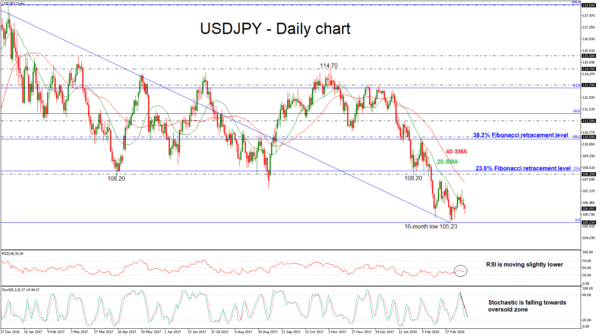

USDJPY fell as low as 105.77 during today’s European session and is recording another negative day. The drop below the 108.20 strong resistance level has pushed the price further lower, creating a 16-month low of 105.23. When looking at the bigger picture, in the weekly timeframe, the price has been trying to break the aforementioned level over the last three weeks.

The negative bias in the near term is supported by the deterioration in the momentum indicators. The %K and %D lines of the stochastic oscillator are falling sharply towards the oversold area, while the RSI indicator is moving lower in the negative zone with weak momentum.

For the time being, 106.00 holds as support for USD/JPY, but a move above 107.00 would be needed to ease the negative flows. However, if prices continue to head lower below the 105.23 support barrier, this could open the way towards the next significant psychological level of 101.00 taken from the low of November 2016.

On the flip side, should an upside reversal take form, the next pause could be on the 40-day simple moving average near 107.70 before a run until the 23.6% Fibonacci retracement level at 108.40 of the downleg from 118.60 to 105.23. A break above this area could shift the bias back to a bullish one, with the next resistance coming from the 38.2% Fibonacci level near 110.50.