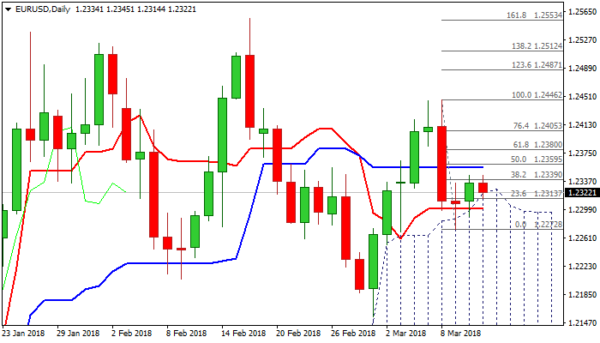

The Euro traded within tight range in Asia on Tuesday with the downside being held by rising 10SMA/top of thick daily cloud (1.2320) and the upside remaining capped for the third straight day by 20SMA (1.2340). Near-term action shows no clear direction as daily studies send mixed signals. Fresh momentum is conflicting mixed MA’s and neutral RSI, suggesting the pair needs the catalyst for fresh direction signal. Rising daily cloud continues to underpin the action since the beginning of the month, but fresh upside attempts from 1.2272 (09 Mar low) face strong headwinds from 20SMA and sideways-moving daily Kijun-sen (1.2355). Bulls need firm break here to generate direction signal and spark further recovery of last week’s strong fall from 1.2446. Initial negative signals could be expected on close below cloud top/10SMA, to expose 1.2300 support (sideways-moving daily Tenkan-sen) and 1.2272/53 (09 Mar low/rising 55SMA). With thin calendar for the European session, focus turns towards key event of the day, release of US inflation data. Forecasts signal that the CPI would fall in February which could be further blow for expectations of US Fed’s more aggressive approach towards interest rates in 2018 and could further depress the greenback.

Res: 1.2340, 1.2355, 1.2380, 1.2400

Sup: 1.2320, 1.2300, 1.2272, 1.2253