EURUSD remains under strong pressure and risk is still to the downside as prices continue to post neutral days after the significant bearish day last Thursday. The short-term technical indicators are flattening and point to more weakness in the market.

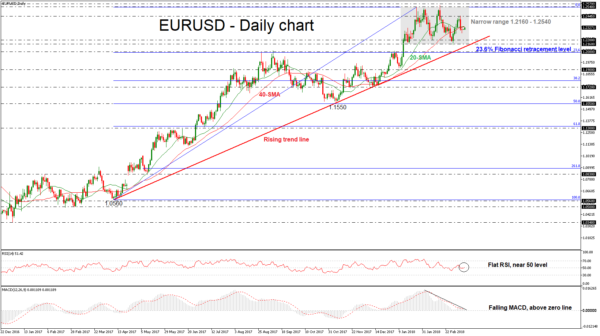

Looking at the daily timeframe, the prices are looking capped by the 20 and 40-simple moving averages which are negatively aligned while a bearish crossover is near. The RSI indicator holds near the 50 level with no clear signal and the MACD oscillator is slightly falling below its trigger line and above its zero line.

The next downside target is the 1.2200 psychological level and the 1.2160 support barrier. At this stage, the market would likely see a resumption of the short-term downtrend and touch the next support at 1.2080, which overlaps with the 23.6% Fibonacci retracement level of the upleg from 1.0560 to 1.2540.

Upside moves are likely to find resistance at 1.2445. Rising above this area could shift the focus to the upside towards the 1.2540 resistance level. Breaking this level could see a test of the 1.2570 high taken from the peak in December 2014.

In the short-term, the pair has been developing within a sideways channel since January 12 with upper boundary the 1.2540 barrier and lower boundary the 1.2160 support. In the bigger picture, the market is bullish as long as the ascending trend line since April 2017 holds.