USDMXN is extending its declines for the sixth straight day, hitting an 11-day low of 18.5853 earlier on Friday.

The RSI has moved below the 50 neutral-perceived level and continues to decline. This is indicative of bearish short-term momentum for the pair.

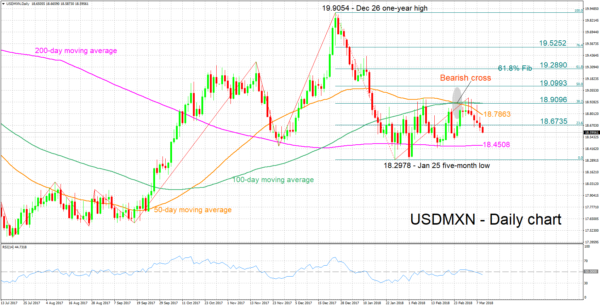

Additional losses could meet support around the current level of the 200-day moving average at 18.4508, with a downside violation bringing into view the five-month low of 18.2978 that was recorded in late January.

On the upside, the range around the 23.6% Fibonacci retracement level of the December 26 to January 25 downleg at 18.6735 might be currently providing resistance. Further above, a resistance area could be formed around the 50-day MA at 18.7863 and the 38.2% Fibonacci mark at 18.9096 (this is where the 100-day MA also lies at the moment).

The medium-term picture is looking mostly bearish, with price action taking place below the 50- and 100-day MA lines, while a bearish cross was also recorded in late February when the 50-day MA moved below the 100-day one.

Overall, both the short- and medium-term outlooks are looking negative at the moment.