Currency pair EUR/USD

The EUR/USD uptrend remains strong and has reached a solid resistance zone (red lines). A bearish reversal could send the EUR/USD lower to test the wave 2 vs 1 (pink) whereas a bullish breakout could indicate a continuation of the uptrend.

The EUR/USD broke above the resistance trend lines (dotted orange) of the rising wedge chart pattern. Price is now testing the Fibonacci levels of wave X (orange).

Currency pair GBP/USD

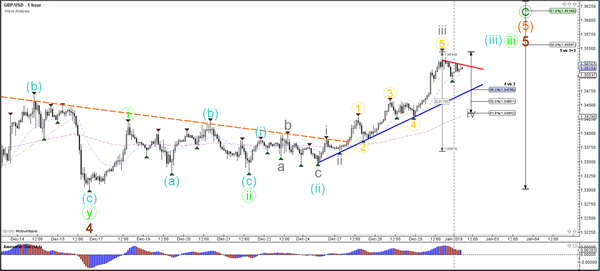

The GBP/USD is challenging the previous top (red) which could be a resistance point. A bullish break could see price move towards the Fibonacci targets of waves 5, which seems to be part of a wave 5 (brown) within wave C (green).

The GBP/USD seems to have completed an internal 5 wave (grey) pattern within a larger wave 3 (blue/green). A bearish retracement could occur as part of wave 4 (grey) but a break below the 61.8% Fib would make a wave 4 (grey) less likely.

Currency pair USD/JPY

The USD/JPY bearish price action has broken below a larger support trend line (dotted blue), which could be part of a larger bearish wave C (purple) correction within wave 2 or B (light purple).

The USD/JPY is building a bear flag chart pattern (blue lines) which could be part of a wave 4 (blue) correction. A bearish break of the flag could see price fall towards the Fib targets of wave 5.