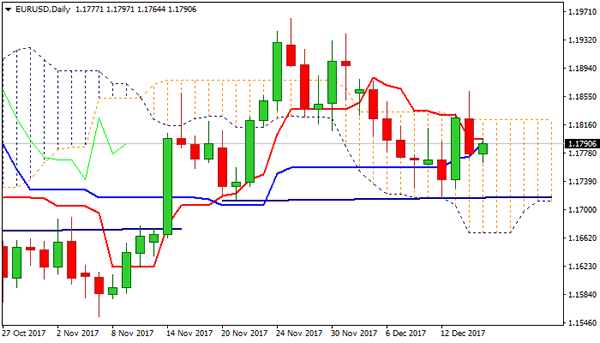

The Euro bounced to1.1800 zone after hitting new low at 1.1764 in Friday’s Asian session trading. Bearish close on Thursday left long red candle with long upper shadow which weighs on near-term action. Euro’s near-term sentiment remains fragile after Fed’s decision on Wednesday boosted the greenback and the ECB kept monetary policy on hold on Thursday’s meeting, but warned about persisting low inflation. Fresh concerns over US tax reform pressured dollar on Friday and may delay Euro’s near-term bears, but downside risk is expected to remain in play while the price holds in the daily cloud. Recovery attempts should be ideally caped at 1.1800 resistance zone to keep key barriers at 1.1819/23 (20SMA/daily cloud top) intact. On the downside, 55 SMA which lies at 1.1759 (just under session low) marks initial support, ahead of pivots at 1.1718/09 (daily H&S pattern neckline/Fibo 61.8% of 1.1553/1.1961 rally) break of which would confirm bearish continuation for attack at daily cloud base at 1.1669.

Res: 1.1800, 1.1823, 1.1862, 1.1878

Sup: 1.1759, 1.1718, 1.1709, 1.1669