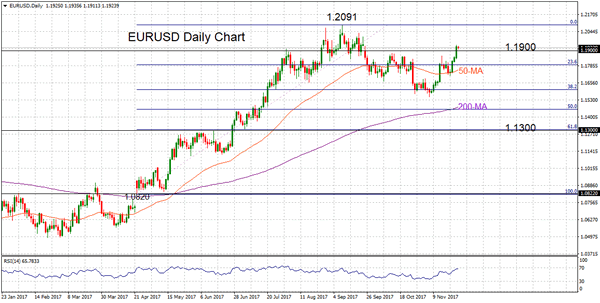

EURUSD is outperforming after a strong rally on Friday that took the pair to a 2-month high of 1.1943. Bullish technical indicators provide room for further upside. The 50 and 200-day moving averages are positively aligned and the RSI is supporting upside momentum.

The market is expected to push higher towards the 1.2091 peak – a level not seen since the end of 2014. Breaking above this top could propel EURUSD higher but in the medium term the market has been trapped in the broad 1.16-1.20 range.

EURUSD is expected to be supported on dips, with the first support at 1.1790. This is the 23.6% Fibonacci retracement level of the uptrend from 1.0820 to 1.2091. Staying above the 50-day MA (1.1753) will help keep the bullish undertone strong. Below this, there is a support zone between 1.1553 (November 7 low) and 1.1606 (38.2% Fibonacci). Any further extension lower would move EURUSD out of its medium-term consolidation phase to target 1.1455 and the key 1.1300 area before turning bearish.

In the near-term, EURUSD is entering a neutral phase around the 1.19-handle as the market appears to be overextended (RSI has reached overbought levels on the 4-hour chart). In the bigger picture, the market is strongly bullish as long as it stays clearly above 1.1900.