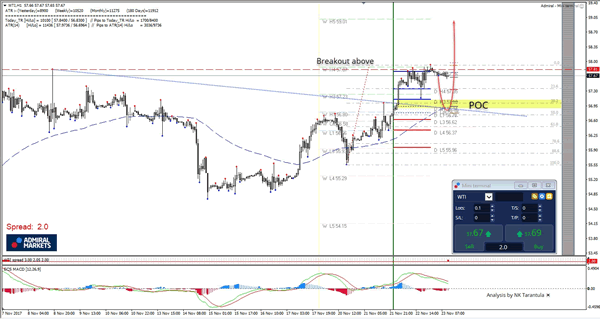

The WTI has been trying to break the W H4 resistance but the price lacks momentum and we can spot a consolidation exactly at W H4 camarilla pivot. If the resistance holds, we might see a retracement towards the POC zone 56.86-59.10 ( D H3, inner trend line, EMA89, D H1, 38.2) and now moment buyers might spike the price again towards the W H4. However the break of 57.90 could spur another momentum buying towards 59.01. So it comes to "make it or break it" scenario. The price is bullish, the WTI is topping out, and buyers are still holding the upper hand.

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC – Point Of Confluence (The zone where we expect price to react aka entry zone)