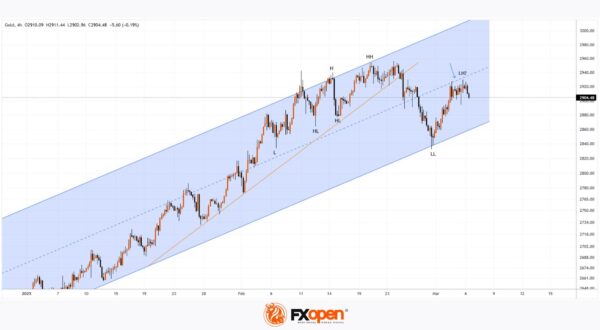

As the XAU/USD chart indicates, gold prices have risen in the early days of March.

Bullish sentiment is being driven by:

→ Investor positioning ahead of key US labour market data – the Non-Farm Employment Change report (due Friday at 16:30 GMT+3), which could provide insights into the Federal Reserve’s interest rate trajectory.

→ Trump’s tariff announcements, adding to global trade tensions – According to The Wall Street Journal, recession fears are resurfacing among market participants. Meanwhile, Barron’s draws a parallel between Trump’s tariffs and the 1930 Smoot-Hawley Tariff Act, which is widely blamed for deepening the Great Depression.

Technical Analysis of the XAU/USD Chart

Gold prices in 2025 are forming an ascending channel (marked in blue).

From a bearish perspective, we observe:

→ A break below an intermediate bullish trendline (shown in orange).

→ The median line of the channel acting as resistance (indicated by an arrow).

→ A bearish Quasimodo pattern (labelled near key price extremes).

From a bullish perspective, gold remains within the blue ascending channel, suggesting that its lower boundary could act as support. If this holds, bulls may attempt to push prices higher towards the key $3,000 psychological level.

However, market direction will largely depend on the broader news backdrop, particularly developments in geopolitics and global trade policy.

Start trading commodity CFDs with tight spreads. Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.