Gold price dipped on Tuesday on partial profit taking, as traders reacted on overbought daily studies, against very supportive fundamentals.

The price spiked to new record high ($2942) earlier today as the latest set of tariffs on steel and aluminium imports in the US raised concerns of escalation of trade war, which could cause a massive negative impact on global economy.

On the other hand, today’s comments from Fed Chair Powell that the central bank is not in hurry to cut interest rates, as the economy remains in good shape and current monetary policy is adequate to stand further economic growth and potential rise in inflation may provide headwinds to metal’s price.

Wednesday’s release of US January CPI will be closely watched.

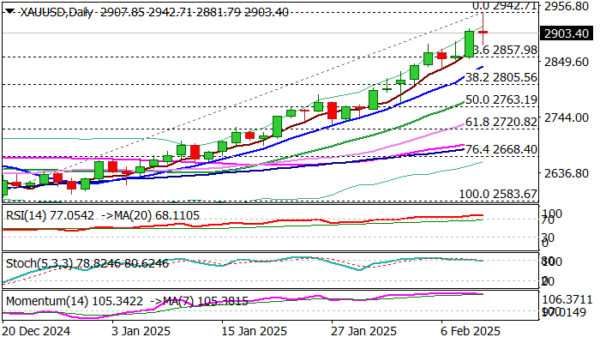

Today’s dip was so far limited with daily action shaped in Doji candle which signals indecision and suggests that more evidence will be needed to have clearer near term direction signal.

This also warns traders of extra caution while trading in this zone.

Initial support lays at $2880 zone (session low / 5DMA) followed by ascending daily Tenkan-sen ($2850) and $2805 (Fibo 38.2% of $2582/$2942 upleg).

On the flip side, projections at $2946/83 mark next targets ahead of key $3000 barriers.

Res: 2942; 2946; 2983; 3000

Sup: 2880; 2850; 2834; 2805