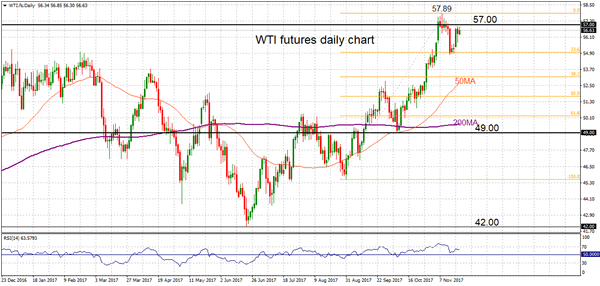

WTI oil futures have been rising steadily and closing above the 200-day moving averages since mid-September. The bullish technical picture was confirmed by the crossover of the 50-day MA above the 200-day MA but the rally lost steam at 57.89 and subsequently, the near-term trend has shifted to neutral.

The market is now trapped between the key round figure of 57.00 and the 23.6% Fibonacci retracement level (54.96) of the latest rise from 45.56 to 57.89. These levels will act as support and resistance in the near term as the market is expected to remain in a consolidation phase. The RSI has turned flat and upside momentum has been exhausted after the market reached overbought levels when RSI rose above 70.

There is room for further strength since the 50-MA is rising. A break above 57.00 would open the way for a re-test of 57.89 and from there, there is scope to resume the uptrend. A fall back into the 53.00 handle (break below 38.2% Fibonacci) would indicate the short-term uptrend has ended.