USDJPY remains constructive and ticks higher on Tuesday, on surprise slowdown in safe haven demand after President Trump imposed new set of tariffs on imports of metals.

Also, investors are taking a breather ahead of today’s testimony of Fed Chair Powell and Wednesday’s release of US inflation report for January, which should provide more details about inflation and further steps of the central bank on monetary policy.

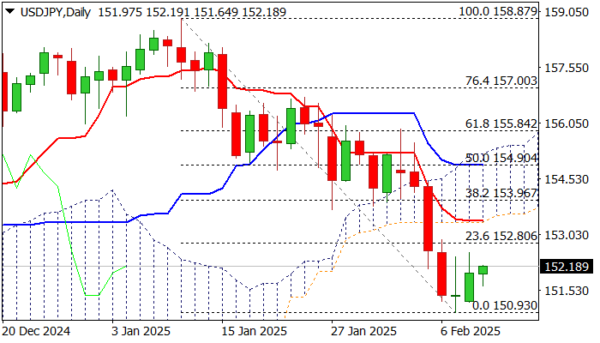

Short term downtrend from 2025 peak at 158.87 (Jan 10) has found a footstep at the zone of important Fibo support (38.2% of 139.57/158.87 at 151.50), where a temporary base is forming.

Current bounce so far looks like a mild correction as daily studies are bearish, with recovery attempts facing strong resistances at 152.77 (converged 100/200DMA’s) and 153.40 (base of daily Ichimoku cloud, reinforced by daily Tenkan-sen).

Broader bears are expected to remain in play while these levels cap recovery and keep in play risk of fresh weakness, with sustained break of 151.50 (Fibo) and 150.93 (last week’s low) to signal bearish continuation.

Last week’s large bearish weekly candle additionally weighs, as the pair was in red for the four consecutive weeks and the action accelerated last week.

Res: 152.77; 153.40; 153.96; 154.90.

Sup: 151.50; 150.93; 150.00; 149.22.