Gold gained nearly 1% in the first trading day in 2025, sending initial positive signal that recovery off $2582 (Dec 18/19 higher base) might be picking up.

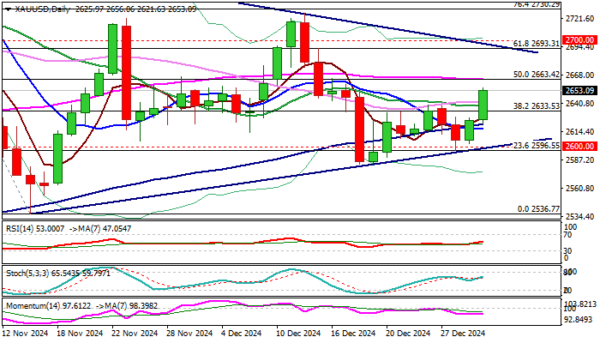

The notion is supported by completion of bullish failure swing pattern on daily chart and breach of important barriers at $2637/42 zone (Fibo 38.2% of $2726/$2582 bear-leg /converged 20/30 DMA’s).

Fresh advance penetrated thin daily cloud (spanned between $2642 and $2663) and pressuring daily Kijun-sen ($2654).

Daily close above $2637 is seen as a minimum requirement to keep fresh bulls in play, as 14-d momentum is still in the negative territory and send warning about possible recovery stall.

Fundamentals are expected to remain supportive for the yellow metal, with unstable political and economic situation, sticky inflation, fiscal instability and still a big question mark above possible action of Donald Trump’s administration, marking a solid ground for further gains.

Gold advanced 27% in 2024, marking one of the most significant actions in the history, compared to rallies in 2011 and 2020 and hit new record high at $2790, that exposed psychological $3000 barrier.

However, there is still a long way to complete a corrective phase ($2790/$2536), with pivotal points laying at $2663 (50% retracement) and $2700 zone (Fibo 61.8% / triangle resistance line / psychological), violation of which to improve near-term picture and shift focus to the upside (double-top at $2721/26) and Fibo 76.4% at $2730).

Res: 2663; 2693; 2700; 2726

Sup: 2633; 2621; 2617; 2600