- Gold prices on course to end 2024 with a 27% gain, the best yearly performance since 2010.

- 2025 outlook is positive due to geopolitical risks, central bank buying, and safe-haven demand.

- Trump administration policies present both risks and opportunities for gold prices.

- Technical analysis shows potential for further gains, but a deeper correction before reaching new highs is possible.

Gold prices slipped yesterday as a stronger US Dollar, anticipation of a hawkish Fed and thin liquidity all contributed. Uncertainties around tariffs and challenges in 2025 are keeping the precious metals appeal going for now and capping further losses.

Gold prices are on track to end the year with a remarkable 27% increase, marking their best yearly performance since 2010.

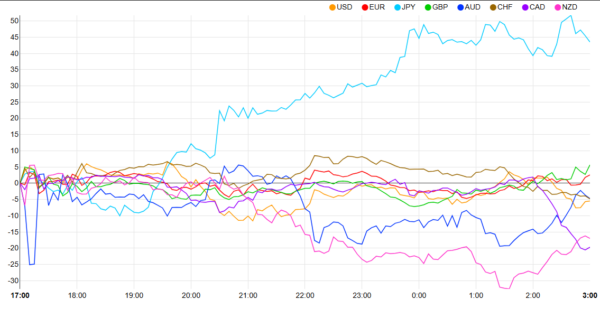

Currency Strength Chart: Strongest – Weakest – JPY, GBP, EUR, AUD, CHF, USD, NZD, CAD –

Source: FinancialJuice (click to enlarge)

2025 Outlook For Gold

Looking at the year ahead and 2025 and it will no doubt be interesting. Geopolitical risk remains a threat with the Middle East still on edge and the Russia-Ukraine situation no closer to a resolution. Just yesterday there were rumors that a proposal by the incoming Trump administration to delay Ukraine joining NATO by 10 years will not be accepted by the Kremlin.

Anyone with knowledge of the situation there will know that this will not change as the main reason for the conflict (at least from a Russian perspective) is Ukraine joining NATO. These developments are likely to keep some geopolitical risk premium in play and keep safe haven demand going.

Global Central Banks were one of the main drivers of the Gold price rise in 2024. This is expected to continue in 2025. The World Gold Council survey revealed in the second half of 2024 that Central Banks are likely to purchase more Gold in the next 12 months. This should further bolster demand for the precious metal.

When it comes to risks affecting Gold prices moving forward, it does get challenging. The reason for this is the incoming Trump administration is expected to do good things for the economy but some policies could lead to higher interest rates. This could weigh on Gold prices.

This is a double-edged sword however, in that the increased risk of uncertainty from Trump policy and concern around the impact of tariffs could actually bolster the demand for safe haven assets and thus Gold.

All in all analysts are largely pricing in further gains for the precious metal in 2025, personally I do see the potential for upside as well. However, I would not rule out a deeper correction before price does actually breach the current ATH resting around the 2790 handle.

The Week Ahead

Today could potentially be a slow day with the New Years holiday tomorrow. In such a case we could see a similar repeat to yesterday’s price action with a slow grind to the downside.

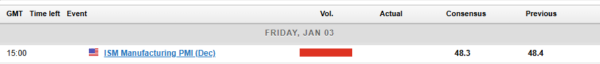

The holiday tomorrow will be followed by a return on Thursday January 2, 2025 which could bring about some volatility to markets as liquidity is expected to start returning to normal. Friday brings the last piece of high impact data from the US with the ISM Manufacturing PMI release.

The data is unlikely to change the overall narrative of the USD and thus any moves inspired by the data is likely to remain short-lived.

Technical Analysis Gold (XAU/USD)

Gold appeared poised for a move higher last week and it very much obliged. The precious metal ran into the first key area of resistance around the 2639 before falling to close the week around 2620.

The two-hour chart below shows the clear change in structure after topping out at 2639 on December 26. Since then, price has printed a series of lower highs and lower lows, breaching the 2600 psychological level briefly yesterday.

There is a descending trendline in play on the two-hour chart with a candle break and close above the trendline potentially leading to a retest of 2639.

A break below the $2600 handle may find support at the long-term ascending trendline which rests around the 2592-2596 range.

Gold (XAU/USD) Two-Hour (H4) Chart, December 31, 2024

Source: TradingView (click to enlarge)

Support

- 2600

- 2592

- 2575

Resistance

- 2620

- 2639

- 2650