- EUR/USD remains range bound as the year comes to a close, with the pair trading just above 1.0400.

- ECB policymakers are cautious about future rate cuts due to a sluggish Euro.

- The US Dollar Index (DXY) held its gains last week, supported by positive US data.

- The lack of liquidity may mean that upcoming US economic data (Pending Home Sales and Chicago Purchasing Managers Index) has little impact on the US Dollar.

EUR/USD finished last week on a positive note despite the rise in the US Dollar Index. EUR/USD traded within a 60-pip range last week as thin liquidity kept any significant moves at bay.

This morning EUR/USD has continued its grind, trading just above the 1.0400 handle. Trading conditions remain choppy with the New Year holiday approaching. For now the status quo remains unchanged, leaving EUR/USD confined to last week’s range.

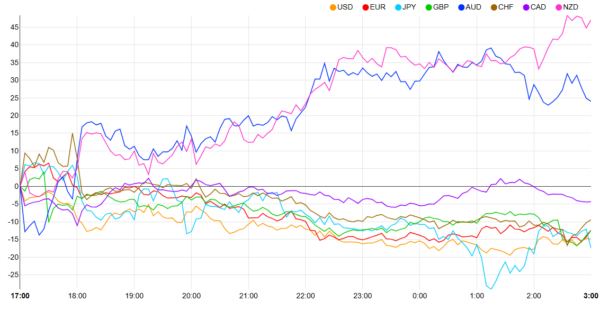

Currency Strength Chart: Strongest – Weakest NZD, AUD, CAD, CHF, GBP, EUR, USD, JPY

Source: FinancialJuice

ECB Policymakers Lead with Caution

ECB Policymakers of late have been cautious in their rhetoric given the developments heading into 2025. The sluggish Euro Area economy coupled with potential threat of tariffs have left policymakers with a lot to ponder.

The cautious approach by policymakers continued over the weekend. In an interview with the Austrian newspaper Kurier, Robert Holzmann, a member of the European Central Bank’s Governing Council, mentioned that it might be a while before the ECB lowers interest rates again. He noted that some energy prices seem to be rising, but there are other ways inflation could increase, such as if the euro loses more value.

The comments will no doubt add to the Euro’s resilience. This in turn could help cap any downside on EUR/USD and keep the pair rangebound.

US Dollar Index (DXY)

The US Dollar Index (DXY) held onto its gains last week as market liquidity thinned. A sprinkling of positive US Data kept the data supported while concerns over rising rates and Treasury Yields have kept the greenback on the front foot.

Later today, the US economic calendar will include the November Pending Home Sales and the December Chicago Purchasing Managers Index.

The lack of liquidity may mean that the data has very little impact on the US Dollar outlook moving forward.

US Dollar Index (DXY) Daily Chart, December 30, 2024

Source:TradingView.com

Technical Analysis on EUR/USD

EUR/USD has struggled for direction since the FOMC selloff on December 18. Since then, EUR/USD has attempted to recover toward the 1.0500 handle but selling pressure persists, capping further upside.

Price action last week saw EUR/USD confined to a range of around 60 pips between the 1.0440 and 1.0380. A break of this range is needed to provide some insights into where the pair may go next.

This week however, has echoes of last week with the New Year holiday and this liquidity. Thus the question is are we in for another week of rangebound price action or will a breakout materialize.

Immediate support rests at 1.0400 before last weeks lows around 1.0380 comes into focus.

Looking at the upside and immediate resistance rests at 1.0440 before the key 1.0500 handle becomes the main area of interest. A break above this 1.0500 handle may lead to further gains as it would indicate a change in structure, potentially putting bulls in control.

EUR/USD Daily Chart, December 30, 2024

Source:TradingView.com

Support

- 1.0400

- 1.0380

- 1.0331

Resistance

- 1.0440

- 1.0500

- 1.0600