- EURJPY erases some gains

- Stochastic and RSI head down

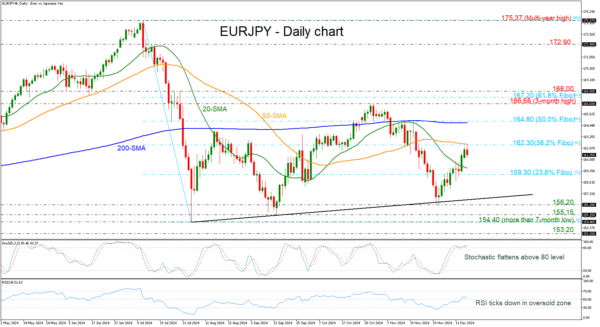

EURJPY has found strong resistance near the 38.2% Fibonacci retracement level of the down leg from 175.37 to 154.40 at 162.30, which overlaps with the 50-day simple moving average (SMA). A downside movement may drive traders towards the 20-day SMA at 159.90 ahead of the 23.6% Fibonacci of 159.30. Steeper decreases could potentially pave the way for the medium-term uptrend line at 156.80.

On the other hand, if the market rises above the critical area of 162.30, it may open the way for the bulls to test the 200-day SMA, which lies near the 50.0% Fibonacci of 164.80. A successful rally beyond this area could send the pair to the three-month high of 166.68.

From a technical standpoint, the stochastic oscillators are flattening in the overbought area, and the RSI is pointing south above the neutral threshold of 50. Both suggest an overstretched market.

All in all, EURJPY has been in a bullish tendency since August but needs a boost to confirm the upside structure.