Gold (XAUUSD) continues to show a positive trend during the European session but stays below the $2,650-2,655 range it has been stuck in for the past two weeks. Friday’s US jobs report boosted expectations that the Federal Reserve will cut interest rates in December, keeping US Treasury yields low and supporting gold prices.

Additionally, political instability in South Korea, global tensions, and trade war concerns drive demand for gold as a safe-haven asset. However, a slightly stronger US Dollar, supported by speculation that President-elect Donald Trump’s policies could push inflation higher, limits gold’s gains.

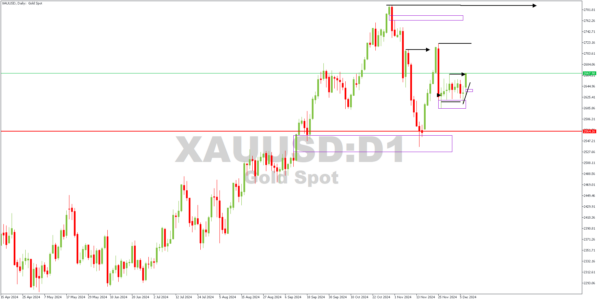

XAUUSD – D1 Timeframe

The price action on the daily timeframe chart of XAUUSD shows a recent bullish break of structure, followed immediately by a retracement and consolidation. The consolidation range has created a base; however, the lower timeframe is expected to help bring the requisite details to light.

H1 Timeframe

In the 1-hour timeframe of XAUUSD, we see a double break of structure pattern formed around the base of the consolidation range, with a recent upthrust from the pattern’s demand zone. The price has also created trendline support that could serve as the confirmed entry for the next bullish impulse.

Analyst’s Expectations:

- Direction: Bullish

- Target: 2695.30

- Invalidation: 2633.61