- US President-elect Trump used his Truth Social network to announce his latest tariff threats.

- Trump vowed to impose 10% additional tariffs on China exports to the US and 25% tariffs on all products from Mexico and Canada.

- The recent two-month rally seen in AUD/JPY has flashed out bearish technical elements.

The financial market has managed to breathe a “sign of relief” on Monday, 25 November after the incoming Trump administration announced Scott Bessent as the US Treasury Secretary nominee last Friday.

Bessent, a Wall Street veteran is being viewed as a more pragmatic person who may favour pro-growth policies (an advocate of Trump’s corporate tax cuts and deregulation policies) over anti-growth initiatives such as steep trade tariffs on China and the rest of the world’s products as part of President-elect Trump’s flagship “American First” policy.

Trade tariffs tantrum déjà vu vibes are back

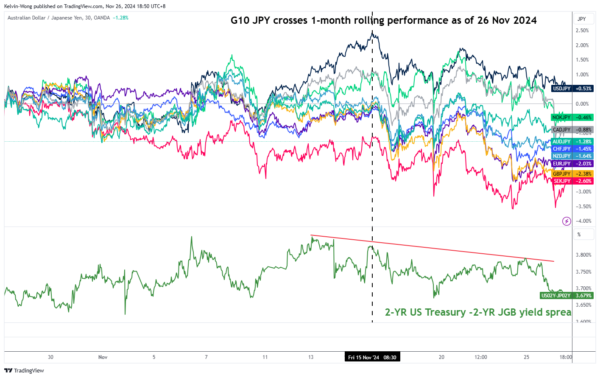

Fig 1: G10 JPY cross pairs one-month rolling performance as of 26 Nov 2024 (Source: TradingView, click to enlarge chart)

Ironically such optimistic viewpoints are being put to a challenge today as “trade tariffs tantrum” déjà vu vibes from Trump remerged. The US President-elect said that he would impose additional 10% tariffs on goods from China and 25% tariffs on all products from Mexico and Canada in social media posts on his Truth Social network to clamp down on migrants and illegal drugs flowing across borders.

These tariff threat comments from Trump roiled the risk-sensitive yen crosses as they traded lower from their respective 15 November peaks (see Fig 1).

A potential bearish reversal looms for AUD/JPY

Fig 2: AUD/JPY medium-term & major trends as of 26 Nov 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the recent two-monthly rally seen in the AUD/JPY from its 11 September 2024 swing low area of 93.65 has started to display inherent technical weakness before this latest bout of Trump’s tariff threat news flow.

Since its 5 August 2024 low of 90.14, the price actions of the AUD/JPY have evolved into a potential bearish “Ascending Wedge” configuration which suggests a potential corrective rally (dead cat bounce) rather than the start of an impulsive upmove sequence (see Fig 2).

Also, the price actions of the AUD/JPY from 3 October to 25 November have stalled at around the key 200-day moving average which suggests hesitation by the bulls.

In addition, the daily RSI indicator has also flashed out a bearish momentum condition since 7 November 2024.

Intermarket analysis also suggests a potential bearish reversal of the AUD/JPY as the yield spread between the 2-year Australian Government Bonds and Japanese Government Bonds has continued to narrow since 31 October 2023 and its recent rebound has been rejected around the 3.70% key resistance level on 1 November.

Watch the 98.20 intermediate support on the AUD/JPY, and a break below it may expose the major support of 93.65 defined by the lower boundary of the long-term secular ascending channel from the March 2020 low.

In the next step, a weekly close below 93.65 may trigger the start of a potential multi-week corrective decline sequence to expose the next support at 87.00 in the first step.

On the other hand, clearance above the 104.95 key medium-term pivotal resistance invalidates the bearish tone for a retest on the major resistance zone of 107.85/109.40.