Gold remains at the back foot and stays in red for the second day on firmer dollar and also pressured by eased US political uncertainty, which recently fueled safe haven demand, along with geopolitics and expectations for stronger Fed rate cuts.

New circumstances after Trump’s victory point to measures which will boost economic growth and subsequently fuel inflation that requires revision of Fed’s current stance on monetary policy.

The latest remarks from Fed Chair Powell suggest that the US central bank will be likely less aggressive in rate cuts and that policy easing cycle would likely end earlier than initially planned, which may further dent metal’s safe haven appeal.

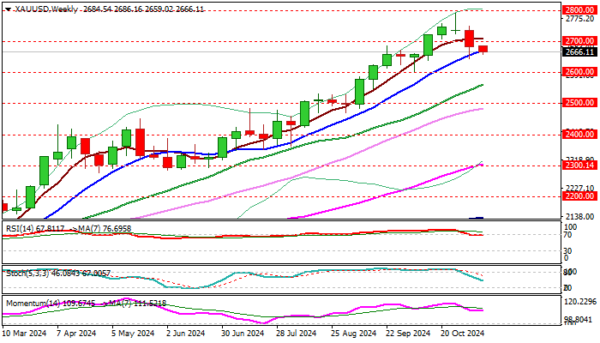

Pivotal supports at $2646/43 (Fibo 76.4% of $2602/$2790 / Nov 7 higher low) came under pressure, with break here to further weaken near-term structure and risk test of key supports at $2616/02 (top of thick rising daily Ichimoku cloud / Oct 10 trough), violation of which to generate reversal signal and open way for deeper correction.

Such scenario won’t be a surprise as gold was in steep uptrend and without significant correction for one year, however fundamentals, currently metal’s key driver, are expected to define fresh direction.

Technical studies weakened on daily chart as negative momentum continues to strengthen, MA’s (10/20/30-d) turned to bearish configuration and south-heading RSI points to more space for downside extension.

Adding to negative signals was last week’s bearish close with the biggest weekly loss since mid-May.

Markets focus on release of US October inflation data and speeches from several Fed officials (due later this week) which would provide fresh details on direction and the pace of changes in the US monetary policy in the near future.

Res: 2686; 2700; 2749; 2758.

Sup: 2643; 2600; 2560; 2471.